Sustainable Development Investments

We identify how investing in 10.121+ companies worldwide contributes to the United Nations Sustainable Development Goals.

Used by leading asset owners

The Entis SDI data set is used by leading asset owners from 3 continents, who together have over US$1 trillion of assets under management.

Covering 10.121+ companies worldwide

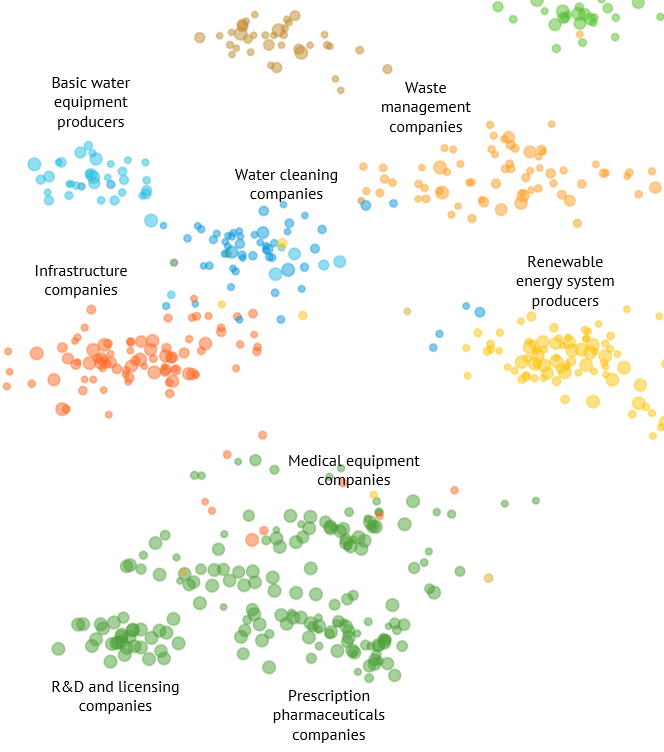

Using our AI powered data factory, this product covers 10.121+ companies worldwide both in the listed-equity and private company space, "which you could never do as an investor going company by company.” - Jennifer Coulson, BCI’s vice president for ESG.

Independent global standard for sustainable investments

The SDI AOP independently reviews and defines the sustainability standards for the Entis SDI data set. The AOP is a board of non-commercial asset owners consisting of, APG, PGGM, BCI and Australian Super.

Investing in solutions that contribute to the UN Sustainable Development Goals

Our detailed report covers per company to which extent they contribute to the 12 investable UN Sustainable Development Goals.

Measuring company alignment with SDGs

The SDI product helps investors to invest in companies that contribute to the SDGs. We measure the alignment of companies to SDGs through their output (products and/or services). The product covers over 10.121 companies worldwide both in the listed-equity and private company space. Companies are assessed using a transparent rule based taxonomy that makes use of both AI and human expertise. Per company we deliver a report containing the SDI score and an underlying rationale. The SDI product is offered trough our partner Qontigo

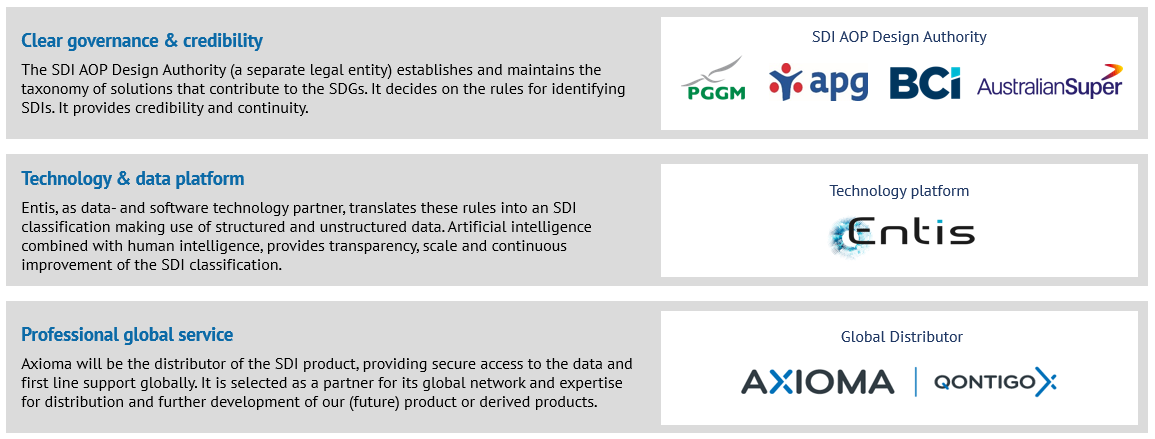

SDI Asset Owner Platform

Comprised of APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM, the SDI AOP is an asset owner-led platform committed to accelerating the market adoption of Sustainable Development Investments (SDIs).

Sustainable Development Goals

The United Nations sustainable devolpement goals are adopted by all United Nations Member States, and provide a shared blueprint for peace and prosperity for people and the planet, now and into the future. Sustainable development investments, are investments that support solutions contributing to the UN Sustainable Development Goals. These investments aid the generation of positive social and/or environmental impact through their products and services. Out of the 17 UN SDG's, 12 goals have been identified to be investable by the SDI Asset Owner Platform.

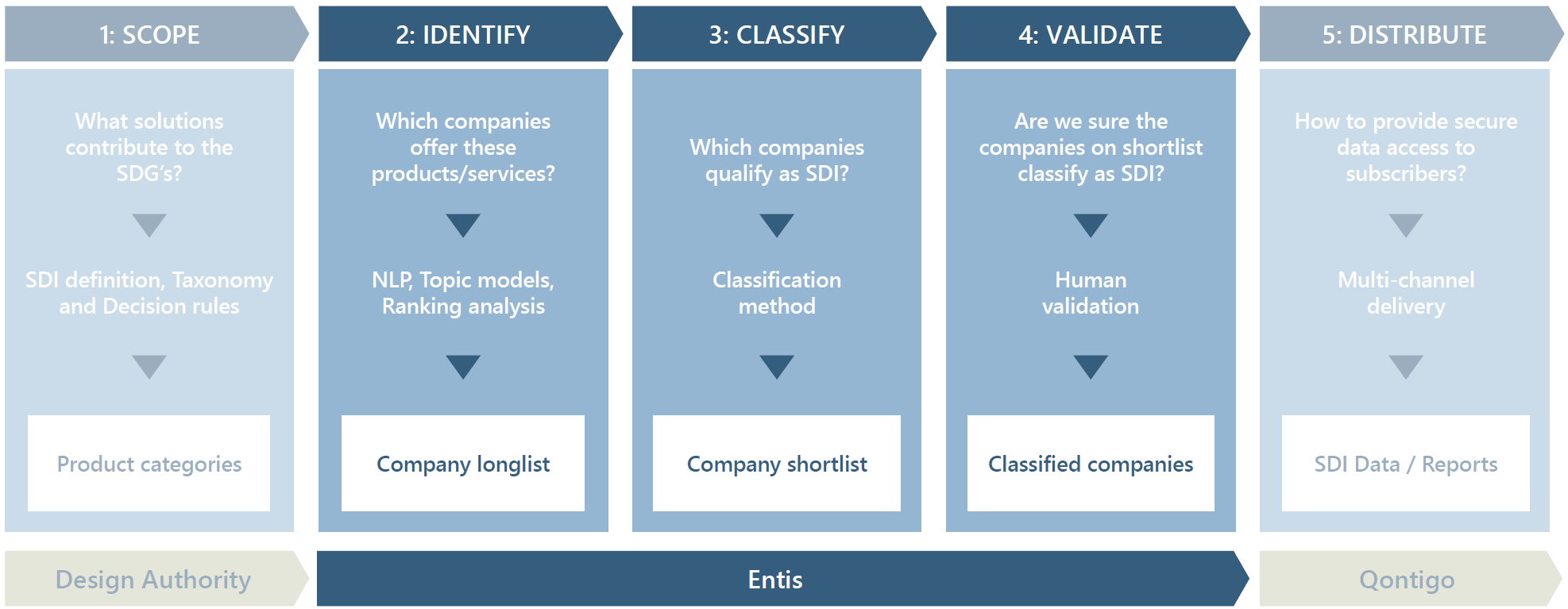

A standard for investing into the SDGs

The SDI AOP Design Authority establishes and maintains the taxonomy and rules for identifying SDIs. Entis translates these rules into an SDI classification making use of structured and unstructured data. Artificial intelligence and machine learning, combined with human validation, provide scale and continuous improvement to the SDI dataset of 10121+ companies. Through Qontigo, the SDI data is provided to customers in a secure way.

Rule-based and auditable

classification

Broad coverage

of global capital markets portfolio

Focus

on companies’ product or service-related contributions to the SDGs (i.e. not ESG)

Objectivity

as it is based on financial metrics (revenues)

Transparency

for NOT mixing positive and negative contributions

Alignment

with large asset owners (credibility)

Continuous improvement and efficiency

through machine learning

Use of unstructured data

through artificial intelligence / natural language processing

Standard-setting with large asset owners

for accelerated market adoption of Sustainable Development Investments

Shape the product development agenda

e.g. for further development of companies’ SDG-specific operations; future contributions

Where to buy

Big asset managers such as APG, AustralianSuper, British Columbia Investment Management Corporation (BCI), and PGGM already use this data set.