Why Sustainable Private Investments Matter

Sustainable investing in private markets is emerging as a critical driver of long-term value and impact. With private equity, private debt, infrastructure, and real estate representing a significant portion of global capital, aligning these investments with sustainability objectives is essential for both risk management and opportunity creation.

Sustainable Private Investment Data

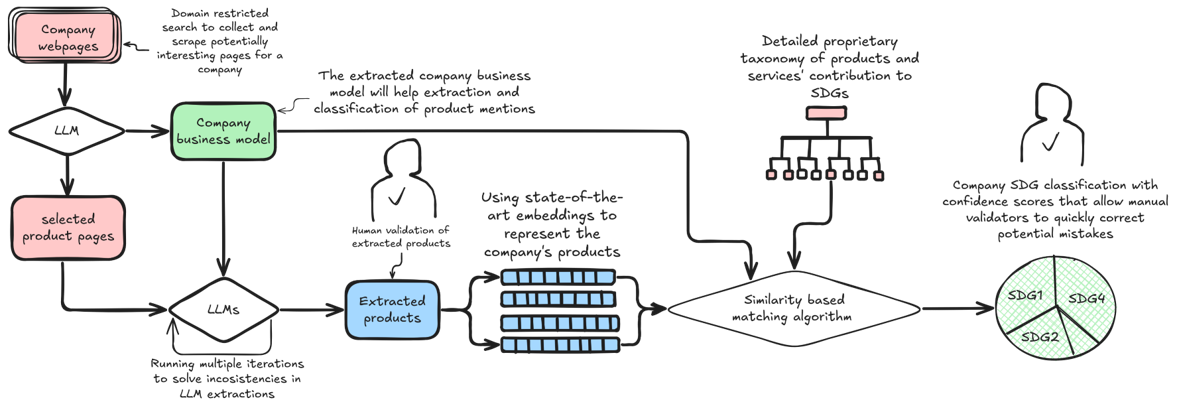

We provide a comprehensive solution for assessing sustainability in private markets. Using a rigorous SDI-aligned framework, EntisAIM evaluates private equity, private debt, infrastructure, and real estate investments, offering consistent and reliable insights.

EntisAIM assessments are tailored to the needs of individual clients ensuring consistent and reliable data. This enables fund managers and asset owners to understand each investment’s contribution to sustainability goals, integrate these insights into portfolio strategy, and make informed decisions that drive both impact and long-term value.

The private market solution ensures consistency through a standardized taxonomy and AI-driven assessment of companies, providing reliable data that forms the foundation for aggregation and comparison.

EntisAIM is built on a robust, purpose-designed technical infrastructure that underpins the entire solution

Our features

Aggregation

Our private market data enables the integration of data from public and private market investments.

Comparison

Allows for comparison across both the public and private markets

Portfolio insight

Brings data together from all private market investments to give the client’s portfolio a holistic view

Decision making

Provides granular insights for optimal decision making

This might be interesting as well